Rental Report: Landlords Aim to Keep Rentals Occupied While Renters Grapple With Financial Challenges

While rent growth continued to slow in March 2023, landlords and renters now face different challenges. Avail, by Realtor.com®, surveyed independent landlords and renters across the US to understand what obstacles they’re facing and how they’re being addressed.

From the data collected, here are four key trends of the independent rental market.

1. Fewer Landlords Plan to Increase Rent

Despite growing concerns about increasing rent prices, we discovered fewer independent landlords are planning to raise their rent prices within the next 12 months. 65.1% of surveyed landlords say they plan to raise the rent of at least one of their properties, which is down from a reported 70.4% in October 2022.

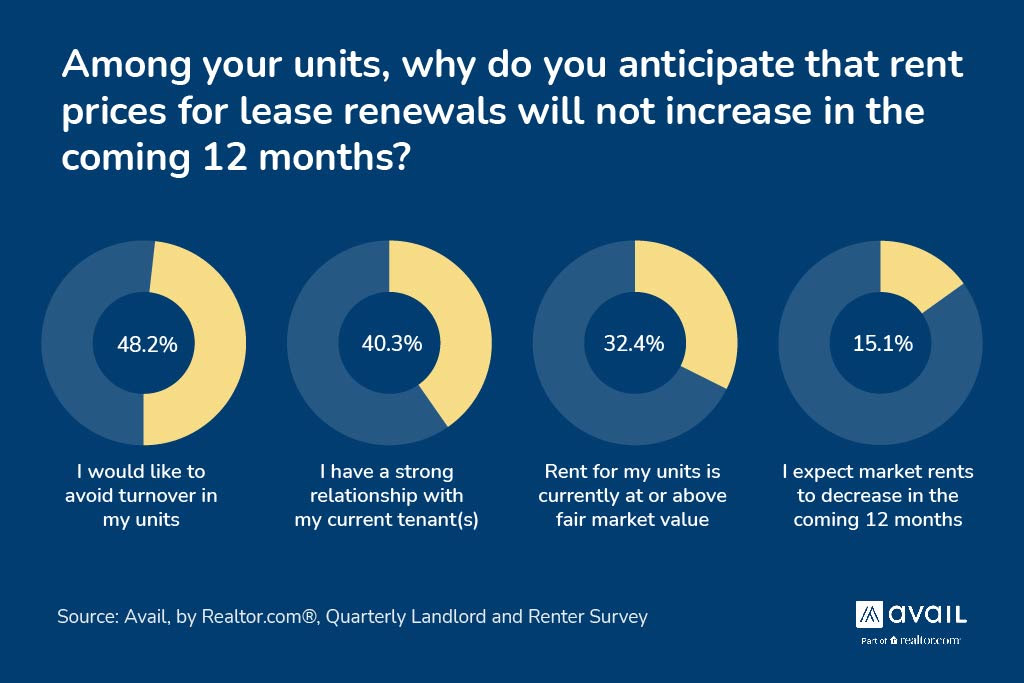

What’s causing landlords to pause rent increases? 48.2% of those surveyed who aren’t raising rent for renewals want to avoid turnover, likely recognizing that finding a new renter may be difficult given current market conditions. Additionally, survey findings suggest that the relationship with their renter is a significant factor. 40.3% of landlords who aren’t raising rent for renewals cite a strong landlord-tenant relationship as a key influence in their decision.

Additionally, 32.4% of surveyed landlords believe that rent for their units is currently at or above fair market value, and 15.1% of landlords expect to see local market rents decrease in the coming 12 months.

2. Landlords Are Focusing on Evictions, Payment History, and Income When Screening Renters

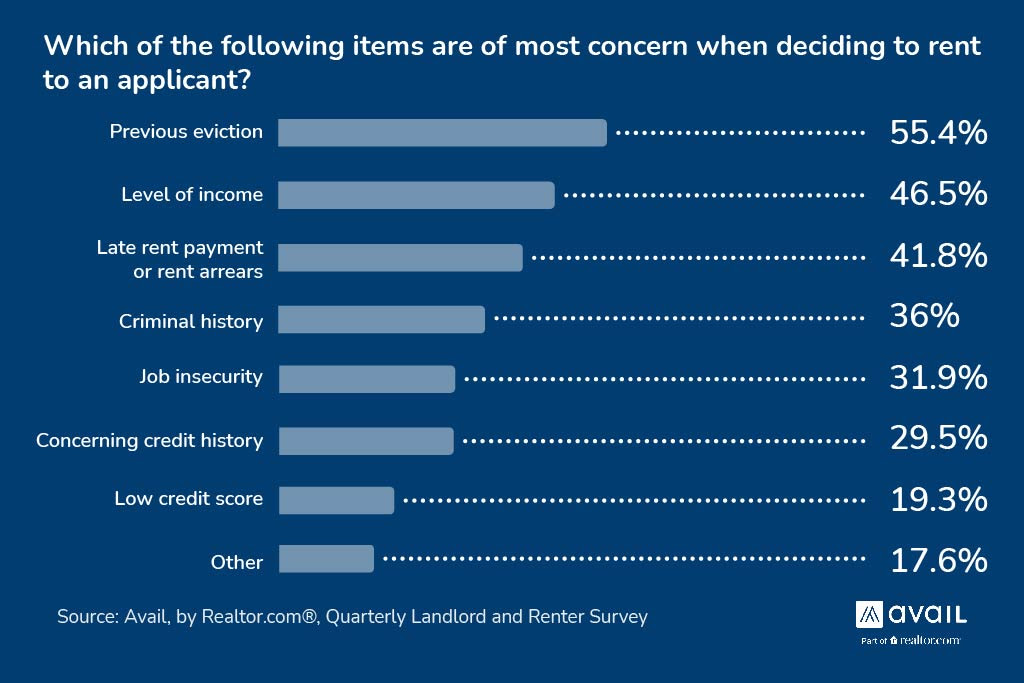

When asked about the most important criteria during the renter screening process, 55.4% of landlords cited previous evictions. 46.5% of said level of income is of major importance, and 41.8% take close note of a history of late rent payments.

However, this doesn’t mean landlords are quick to reject renters based on these factors — especially considering how many renters were impacted by the pandemic. 58.3% of landlords are willing to let a renter explain negative information on their application and only 35.1% reject applicants 50% or more of the time.

3. Fewer Renters Are Negotiating Smaller Rent Increases, But Success Rates Are Improving

Rent growth may be slowing, but prices are still higher than they were several years ago, making affordability a main concern for renters. However, even though more than half (54.9%) of surveyed renters feel they can’t afford a rent increase, fewer renters attempt to negotiate a more minor price hike. Of those who recently renewed their lease, only 28% tried to negotiate with their landlord. This is down from 34.7% in October 2022, and 38.7% in July 2022.

Despite the dip in renters attempting to negotiate, the success rate is on the rise. In fact, 25.4% of renters were successful in their negotiation attempts, up from 17.3% in October 2022.

One of the major contributing factors to this increase in successful negotiations appears to be how long the renter has lived at the property. More than half (51.8%) of surveyed landlords say they’re more likely to negotiate with renters who have lived in the unit for multiple years. This is despite the fact that 30.5% of landlords say they’d be extremely unlikely to negotiate when renewing a lease, and 27.6% claimed to be somewhat unlikely.

4. Renters Continue to Struggle With Home-Buying Goals

Successful negotiations may be a small win for renters, but other financial challenges still persist. For example, 66.3% of renters still feel they’re saving less each month than 12 months ago. Even though this is down from the 70.6% reported in October 2022, it’s likely a result of factors like inflation and recent rent increases.

Furthermore, less than one-third (30%) of renters are considering purchasing a home in the next 12 months, continuing a downward trend from 34.6% in July 2022 and 32.3% in October 2022. While they’re still considering a home purchase, 81.9% of these renters agree that rising interest rates and inflation have impacted their plans to buy a home, and 65.9% are delaying their purchasing plans.

Of renters who aren’t considering purchasing a home within the next 12 months, more than half (59.7%) don’t feel they have enough saved for a down payment. Furthermore, 41.1% of renters don’t believe they’d qualify for a mortgage — a drastic increase from the 19.6% reported in October 2022.

To help navigate these obstacles, renters are making compromises in their renting preferences. Nearly half of surveyed renters are considering a location-based change to help save on rent. 21.1% have thought about moving to a cheaper or less-desirable neighborhood, 19% are considering moving to a more affordable area in the state, and 15.6% see moving to an affordable area out of state as a viable option.

Landlord Data: Portfolio Size, Unit Types, and Median Household Income

- Nearly three in ten (28.7%) landlords own one rental property, while 38.1% own two to four properties. 15.9% of landlords own between five and nine rental properties.

- Of rental properties owned, more than half (55.5%) of landlords rent out a single-family home. 31.2% of landlords have two- to four-unit properties, and 9.6% possess rentals with five to 24 units.

- The median household income for surveyed landlords is $125,000.

Renter Data: Unit Type, Average Rent, Median Household Income

- 47% of renters currently rent a single-family home. 27.6% live in a two- to four-unit property, and 11.9% of renters live in a five- to 24-unit property.

- The median rent price for surveyed renters is $1,388.

- The median household income among renters surveyed is $50,000.

Research Methodology

The Avail Q1 2023 Landlord and Renter survey collected responses from a nationally representative sample of more than 2,500 independent landlords and renters. The survey was conducted between March 28th, 2023, and April 7th, 2023. The margin of error for landlords is ± 2.5%, and ± 3.2% for renters.