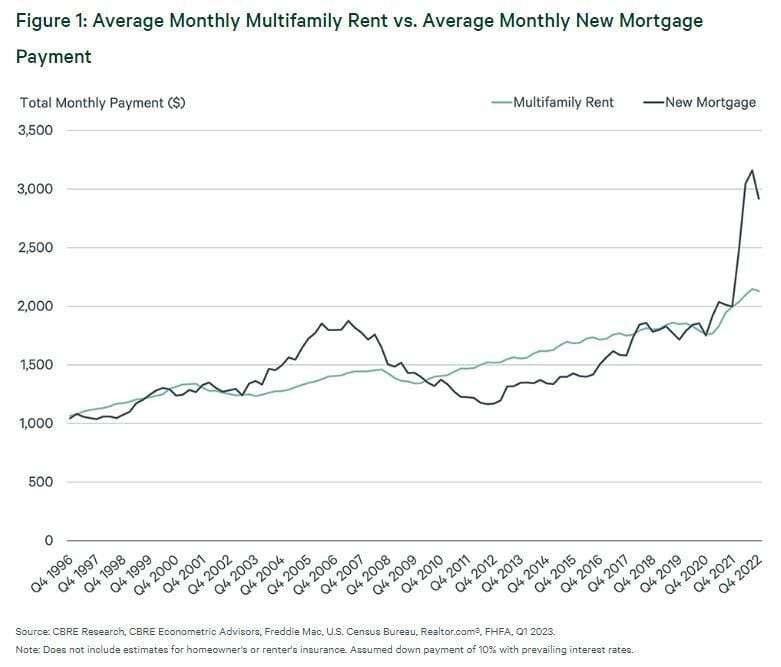

Mortgage Payments Higher Than Monthly Rents Nationwide

Uphill battle for homeownership: In the past, monthly mortgage payments for newly bought homes were close to monthly apartment rents. That’s changed in recent years with rocketing mortgage rates and sky-high asking prices. Since 2019, average monthly mortgage payments have jumped 70%. And even though home prices have fallen 9.7% since Q2 2022, it hasn’t balanced out higher mortgage rates. For that to happen, prices would have to fall another 24% this year alone.

The grass is always greener elsewhere: Home valuation premiums vary from market to market, but in nearly every major U.S. metro, monthly mortgage payments are significantly higher than rents. For instance, New York and San Francisco premiums shot up because of higher home prices and slower multifamily rent growth. Meanwhile, Miami and Kansas City have seen increases in rent and home prices as migration from higher-cost-of-living metros continues apace. Currently, San Jose, Austin, Seattle, Kansas City, and Salt Lake City have the highest ownership premiums in the nation.

| Hungry for homes: The low supply of homes is also a hurdle for potential homebuyers. But it’s no surprise why nobody wants to sell—they’re holding onto those pandemic fixed rates for dear life. More than half of active mortgages originated during the pandemic, and many are refis. In fact, almost 97% of active mortgages have interest rates below current levels. Unsurprisingly, there are 34% fewer active listings now than in Q4 2019, and with mortgage rates at 6.42% in March, most Americans aren’t willing to take the plunge. |

| ➥ THE TAKEAWAY |

| This, too, shall pass: CBRE anticipates that any negative impact on market fundamentals will remain temporary. The housing shortage and higher rates have kept the demand for rentals strong. Ultimately, lower mortgage rates will have the largest impact on monthly payments as inflation decreases and the Fed eventually lowers interest rates. |