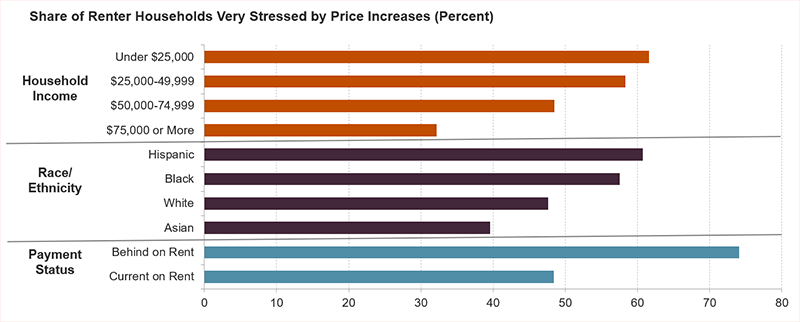

Large Shares of Renter Households Are Feeling Very Stressed About Inflation

Note: Black, Asian, and white respondents are non-Hispanic. Hispanic people may be of any race. People identifying as another race or multiple races are not shown.

Source: JCHS tabulations of US Census Bureau, Household Pulse Surveys, July–December 2022.

Renters who were behind on rent at the time they were surveyed also experienced inflation differently from those who were caught up. A slightly higher share of renters in arrears reported that consumer prices were increasing in their area. Being behind on rent shaped how stressed these renters felt about increasing costs. Nearly three-quarters (74 percent) of renters in arrears were very stressed about rising consumer prices, compared to just under half (48 percent) of those who were current on their rent payments.

Renters who perceived that prices were increasing coped with this stress in a variety of ways. The most common strategy was shopping at stores with lower prices, looking for sales, or using coupons. Renters also cut back on how much they ate out, and many delayed major expenses or purchases. About a quarter of renters delayed medical treatment, and a slightly smaller share asked their friends or family for help. Just 7 percent of the renters who noted prices were increasing in their area moved to less expensive housing, perhaps speaking to both the cost of moving, the tightness of rental markets, and the lack of affordable options.