The Real Story Behind Those Rising Rents

We have all seen the headlines: Rents are up 20%, 30%, and even more in some places. Policymakers have latched onto those headlines to justify new rent control proposals across the country. While eye-catching, the data indicates the media narrative doesn’t tell the real story.

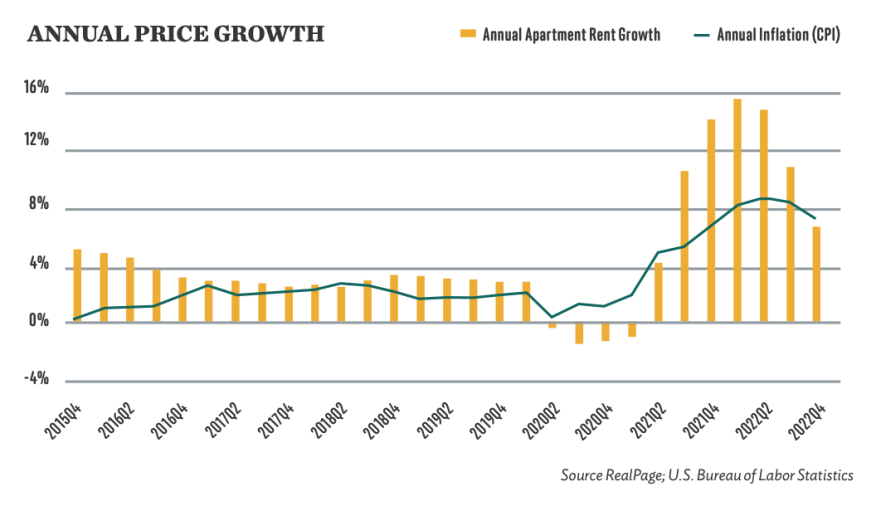

Rent growth did climb to record highs in late 2021 and into early 2022, peaking at 15.3% year over year in 2022’s first quarter among professionally managed apartments tracked by RealPage. But that year-over-year figure distorts the larger picture, ignoring the rent decreases in 2020 and late 2022. If one expands the time frame to the past three years, rent growth has averaged 6.3% annually.

Rents Have Been on a Roller Coaster

As anyone in the apartment industry knows, 2020 was an uncharacteristically weak market thanks to COVID-19. By the third quarter of 2020, effective asking rents had fallen 1.4% from a year earlier. The historic increases seen in the following years were partly a recovery from this trough and were not long-lived. Rent growth started to moderate in the latter half of 2022, with rents decreasing during the last four months of the year.

Those market gyrations are why taking a longer view on rent growth is essential. A longer view also captures rising inflation’s impact on real rent growth. Overall goods and services prices rose, on average, 5% from the fourth quarter of 2019 to the fourth quarter of 2022, well above the 1.7% average from 2014 to 2019.

After adjusting for inflation, effective asking rents tracked by RealPage grew 1.2% annually during that period. This is actually less than the average 1.6% annual rate for the preceding five years. Real rent growth—the amount that rent growth exceeds inflation—has decreased in recent years. It has even turned negative in some high-cost coastal markets and for smaller unit types.

For instance, nationally, real rents for studio apartments fell 1.1% between 2019 and 2022. In Seattle, they fell nearly 4%. They dropped 2.3% in Boston, 2.1% in Los Angeles, and 8.9% in San Francisco.

Homeownership Costs Are Skyrocketing

On the other hand, the cost of homeownership truly is skyrocketing. Thanks to rapid home price appreciation and rising interest rates, the monthly cost of homeownership has grown far more than rent and other consumer goods in recent years.

From December 2019 to June 2022, the median sales price of existing homes grew nearly 50% or an average of 17.4% per year, far exceeding the 5.9% average annual rate for the preceding five years. Prices have started to fall because of rising rates, but not enough to offset higher mortgage costs.

Over the past three years, the monthly cost of a newly purchased home—assuming a 10% down payment and 30-year fixed-rate mortgage—has increased 71%, or an average of 19.7% per year.

As of the fourth quarter of 2022, owning a house cost $1,176 more each month than renting a professionally managed apartment. This is the highest inflation-adjusted buy-to-rent premium since the peak of the housing bubble in the third quarter of 2006.

Housing Supply Lags Demand

The cost of all housing, rented and owned, has been rising for decades because the U.S. has a chronic undersupply of all housing types. In 2021, 58% of apartment households were spending more than 30% of their income on rent, up from 42% in 1985. The share paying more than half their income jumped from 21% to 31%.

For homeowners, 28% spent more than 30% of their income in 2021, up from 20%, and 14% were spending more than half their income, up from 7%.

When we fail to build enough housing, costs rise. To ease the cost of housing, we must build more of it and double down on efforts to renovate and preserve our existing, aging stock.

Bruno Friia: This is why being a Property Manager, your growth and success will continue.